Antifragility

Antifragility is a term that became widely known after the 2008 financial crisis, because it comes from Nasim Taleb, who successfully predicted what would happen. He did not predict the magnitude of the disaster, but he did suggest that there would be a Black Swan moment that would change the way the financial system works. We often use the term without understanding exactly what it means and what kind of organization is resilient to shocks and can use them as a source of its growth as well.

Taleb is originally from the Levant (roughly today’s Lebanon, Syria and bits and pieces of other countries around it), a region of relative freedom in a troubled part of the world in the days of his youth. That changed over time, and Taleb left for the United States, where he pursued academic pursuits and investing.

His research and observation of his surroundings eventually led him to many conclusions, and antifragility is one of them. Another very familiar and closely related term is the black swan.

What is Antifragility?

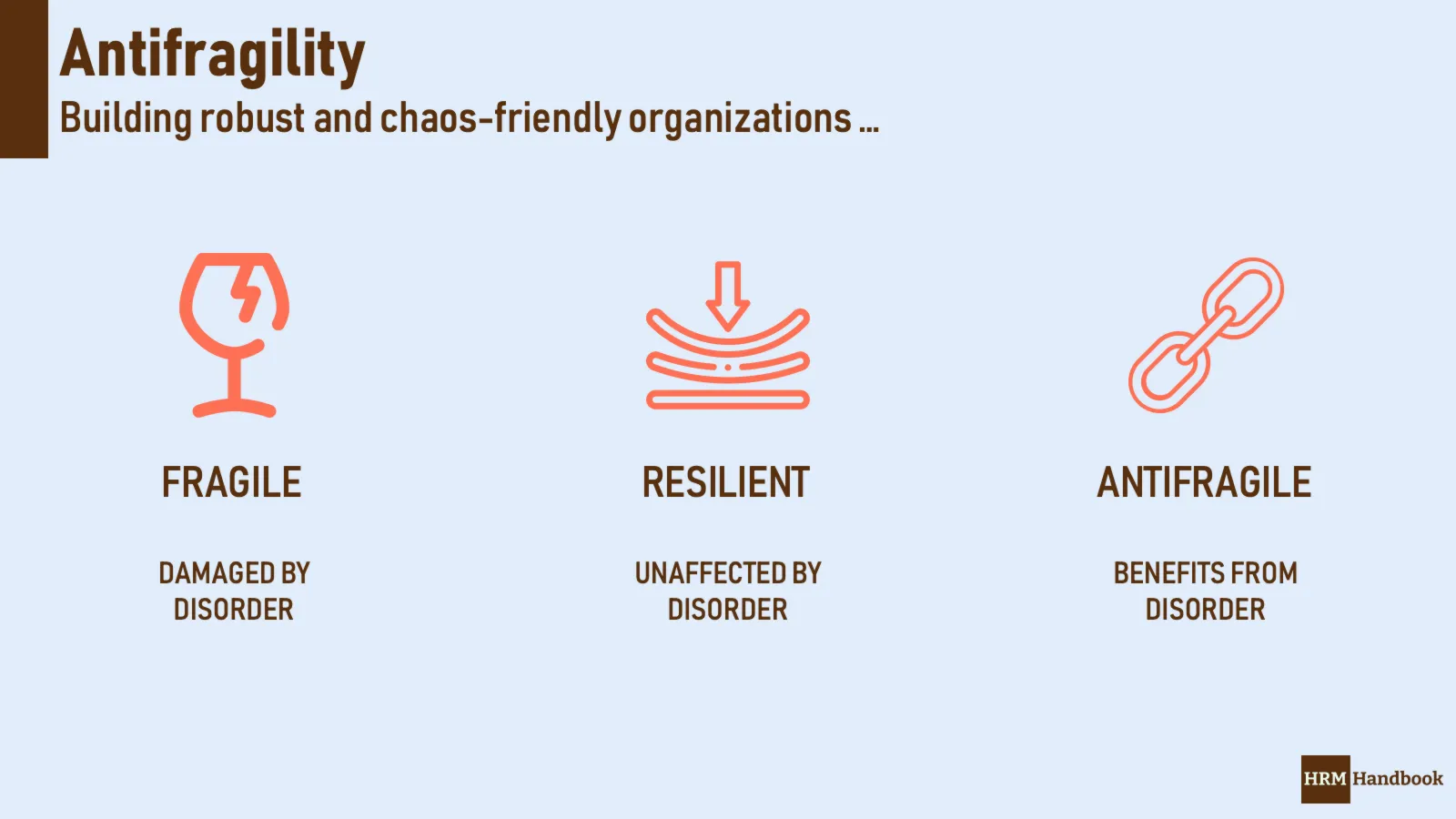

Anti-fragility describes a category of things that not only benefit from chaos, but perhaps even need it to survive and thrive. The term antifragility is a new term that is being used as a description in opposition to fragility. And at the same time, the previously used term “robustness” is not accurate. Antifragility goes beyond robustness; it means that something not only resists shocks, but actually improves because of them.

How to understand antifragility correctly

In his book Anti-fragile: Things That Gain from Disorder from 2012, Taleb offers the following definition:

“Some things benefit from upheaval, thrive and grow when exposed to volatility, randomness, disorder and stressors, and love adventure, risk and uncertainty. Despite the ubiquity of this phenomenon, however, there is no word that describes the exact opposite of the word fragile. Let’s call it anti-fragile. Anti-fragility is more than resilience or robustness. Resilient resists shocks and stays the same; anti-fragile improves.”

The central theme of the book is that we need to learn how to make our public and private lives (our political systems, social policy, finances, etc.) anti-fragile, not just less vulnerable to randomness and chaos. By adapting to non-linear events, we can take advantage of stress, error and change, which are all but certain anyway.

According to Taleb, “we make the economy, our health, our political life, our education, almost everything more fragile” by “suppressing randomness and volatility,” just as “systematically preventing forest fires ‘just in case’ makes the big one much worse.

The concept of antifragility can be applied to a variety of disciplines, including physics, molecular biology, transportation planning, physical fitness, engineering, project management, computer science, and risk analysis.

Staying out of debt and avoiding over-optimisation

Taleb offers several examples of how the world and its population can become less fragile. One example that appears regularly in his book is the importance of not going into debt: “If you don’t go into debt, you don’t care about your reputation… and it’s only when you don’t worry about your reputation that you tend to have a good reputation.”

According to Taleb, zero debt is a prerequisite for political antifragility. He argued that governments should adopt hard fiscal conservatism because debt makes them fragile. Taleb also called for increasing redundancy “in some spaces” and avoiding optimization, even though it goes against everything portfolio theory teaches.

“I’ve always been very skeptical of any form of optimization,” he said. “In a world of black swans, optimization is not possible. The best you can achieve is reduced fragility and more robustness.” Taleb describes an anti-fragile business strategy as one that not only withstands a turbulent market, but becomes more attractive under such conditions.

How to become antifragile

Taleb likens antifragility to the hydra, a creature from Greek mythology that grows two heads if it loses one of them. While other creatures could be defeated by cutting off the head, the hydra would actually grow stronger.

Like the hydra, the antifragility system does not rely on a single “head”. This means reducing the number of potential bottlenecks and choke points by using redundant systems and fail-safes. These redundancies may seem inefficient if everything works perfectly - but nothing works perfectly.

Stress is another element of antifragility, and Taleb again uses a physiological metaphor. Just as concentrated effort can help build muscle and bone, a well-controlled burst of stress can help organizations evolve and adapt to potential challenges.

Antifragility for Business (and Human Resources)

For businesses, antifragility means avoiding dependence on any one product or strategy. Instead, an anti-fragility enterprise is one that invests in multiple potential growth paths and retains the ability to pivot and redirect its energy when one of those paths closes. This means avoiding debt and unnecessary expenditures to limit potential downsides.

It is also important for Human Resources to keep the system open and not put everything on one card. HR must make sure that there is no dependence on any one person in the company. The art of spreading know-how and encouraging broad discussion eliminates the consequences of wrong decisions, exactly according to the principles of antifragility. Such thinking must become part of the company culture.