Compensation and Benefits

Compensation and Benefits (C&B) are a vital function of Human Resources. Simply put, compensation is the term used to describe the financial value that an employee receives in exchange for their work. This can include salary, base pay, and other forms of compensation such as bonuses or commissions (variable pay and performance-related recognition).

Benefits, on the other hand, refer to the non-financial perks that an employee is entitled to, such as healthcare, paid time off, or retirement savings plans. Together, compensation and benefits play a crucial role in attracting and retaining top talent.

Compensation and Benefits can actually play a role in increasing shareholder value. Let’s take a deeper look at how this works.

Shareholder value is created when the company’s stock price goes up, which in turn increases the shareholders’ equity in the company. But how do compensation and benefits tie into this?

Well, first of all, attracting and retaining high-quality employees is essential to any company’s success. In order to do this, you need to offer competitive compensation and benefits packages. This not only helps to attract top talent but also keeps your current employees happy and engaged in their work. And engaged employees are more productive employees, which leads to better business results and ultimately increases shareholder value.

Compensation components can be broadly classified into two categories: base pay and variable pay. base pay includes the guaranteed salary or hourly rate that an employee receives. Variable pay, on the other hand, is anything that isn’t base pay, including bonuses, benefits, long-term incentives, and sales incentives.

Although the specific compensation components offered by a company will vary depending on the organization’s size and industry, base pay and variable pay are the most common types of compensation. base pay is typically the largest component of an employee’s total compensation, while variable pay makes up a smaller portion.

However, in some industries and companies, variable pay may be a larger portion of an employee’s compensation than base pay. For example, commission-based sales jobs typically have a higher percentage of variable pay than base pay. ultimately, the mix of base pay and variable pay will be determined by the employer based on what they feel is necessary to attract and retain employees.

So as you can see, compensation and benefits play a vital role in creating shareholder value. By attracting and retaining high-quality employees, companies can position themselves for long-term success and create lasting shareholder value.

Compensation and Benefits support a business’s strategy and goals by attracting, retaining, and engaging employees. By offering competitive salaries and a comprehensive benefits package, businesses can attract top talent and keep employees happy and motivated.

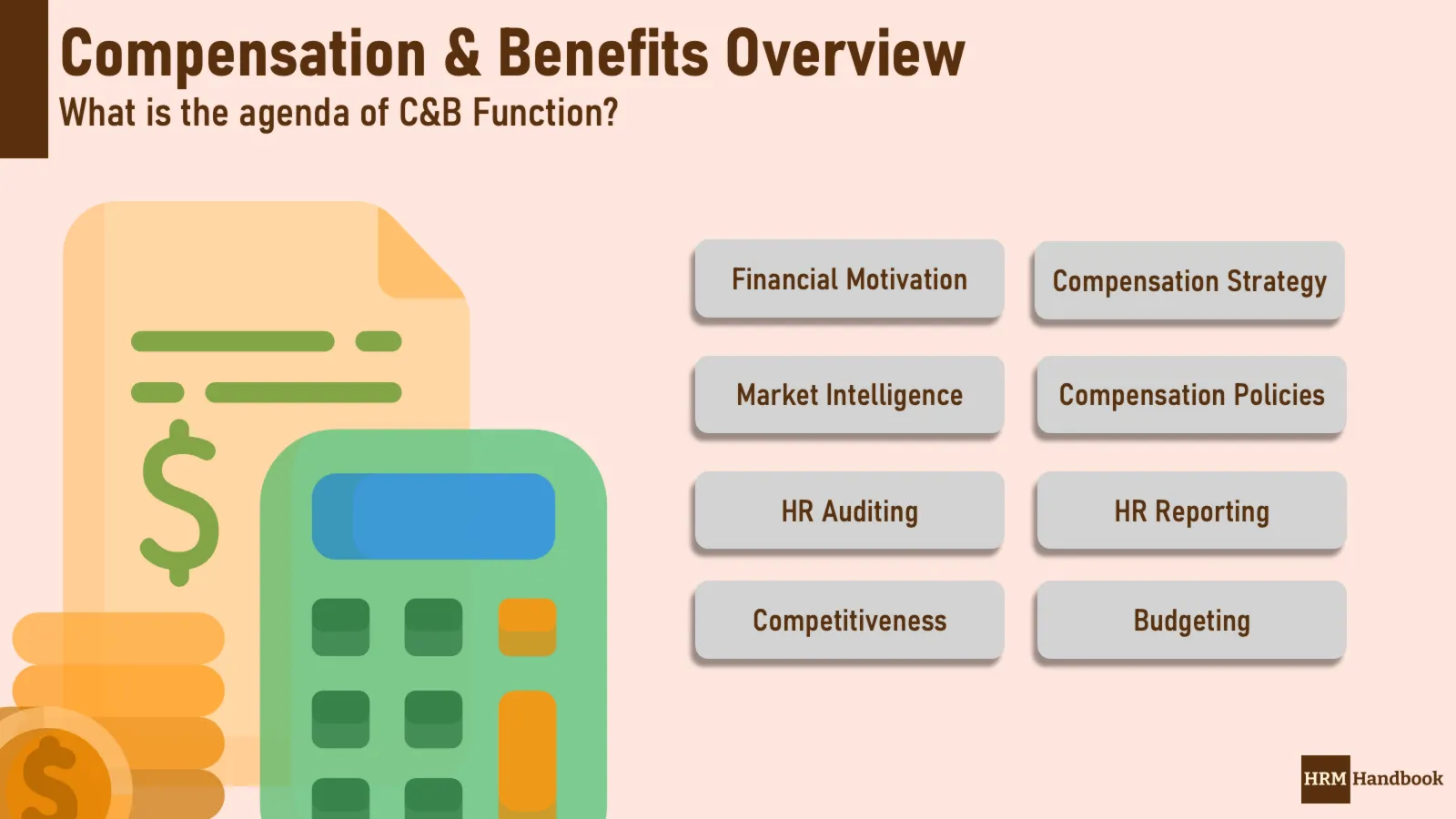

Motivation is key in any work setting - it is what drives employees to achieve goals and meet deadlines. There are two main types of motivation: financial and non-financial. Financial motivation is typically in the form of salary or bonuses, and it is often the most effective form of motivation as it directly links performance with rewards.

Non-financial motivation is more difficult to quantify, but it can take the form of recognition, praise, or simply a sense of satisfaction from doing a good job. Ultimately, the best motivation is a combination of both financial and non-financial incentives that are tailored to the individual.

By understanding what motivates each employee, employers can create a work environment that is motivating and productive.

A well-designed compensation and benefits program can also help to align employee goals with the company’s strategy, ensuring that everyone is working towards the same objectives. In short, compensation and benefits are an essential part of any business’s ability to deliver on its strategy and achieve its goals.

A job candidate’s compensation package is one of the most important factors that they consider when making a job decision. A competitive offer can help to attract the best and brightest job candidates, who are then more likely to accept the position.

The most effective compensation packages are those that are tailored to the individual job candidate’s needs and preferences. For example, some job candidates might value a higher salary more than other benefits, while others might place a greater emphasis on paid time off or flexible job hours. By understanding what each job candidate values, employers can make a more competitive offer that is more likely to result in a job acceptance.

By offering a competitive compensation package that meets or exceeds the market rate, organizations can ensure that they can attract the best candidates. Additionally, by ensuring that compensation is fair and equitable across all employees, organizations can maintain a high level of morale and motivation. In sum, compensation and benefits are critical components of any successful Human Resources strategy.

Employee retention is a crucial part of cost management for any business. The cost of losing and replacing an employee can be significant, and it can also lead to a decrease in employee morale. As a result, businesses need to be aware of the relationship between employee retention and compensation and benefits.

A competitive salary is comparable to what other businesses in your industry are offering for the same types of positions. There are several ways to research competitive salaries, including using salary surveys and conducting your own market analysis.

When setting salaries for your employees, it’s important to consider the cost of living in your area and the skills and experience level of each individual. While it can be tempting to offer lower wages to save on costs, keep in mind that this could make it difficult to attract and retain top talent. Ultimately, providing competitive salaries is essential for attracting and retaining high-quality employees.

One way to improve employee retention is to offer competitive compensation and benefits packages. This includes not only base salaries but also things like health insurance, 401k matching, and tuition reimbursement. By offering these types of benefits, businesses can attract and retain high-quality employees.

In addition, businesses should regularly review their compensation and benefits packages to ensure that they are keeping up with the market. By doing so, they can maintain a strong employee retention rate and avoid the high costs associated with Employee Turnover.

Job analysis is critical to maintaining internal equity within an organization. By regularly analyzing job descriptions and requirements, employers can ensure that all employees are fairly compensated for their skills and experience. This process can also help to close the gender pay gap by identifying and correcting instances of wage disparities.

In addition, job analysis can help organizations to plan for future staffing needs, ensuring that they have the right mix of talent to meet business goals. Ultimately, internal equity is essential for a fair and productive workplace, making job analysis an essential tool for all employers.

Performance management and Compensation are two closely related topics in the world of Human Resources. Performance management is the process of setting goals and measuring progress towards those goals.

Compensation, on the other hand, is the process of providing financial incentives to employees in exchange for their performance. The two topics are often intertwined because performance measures are often used to determine compensation levels.

For example, an employee who meets or exceeds their performance goals may be eligible for a bonus or pay raise. In this way, performance management and compensation are two tools that companies use to improve employee productivity.